City receives six additional proposals to develop two acres in downtown St. Pete

/A rendering of Atlas Real Estate Partners’ proposal for a 2.02-acre site in downtown St. Pete. Atlas has proposed a 10-story mixed-use building that would include 310 residential units, retail, co-working space, and public & private parking.

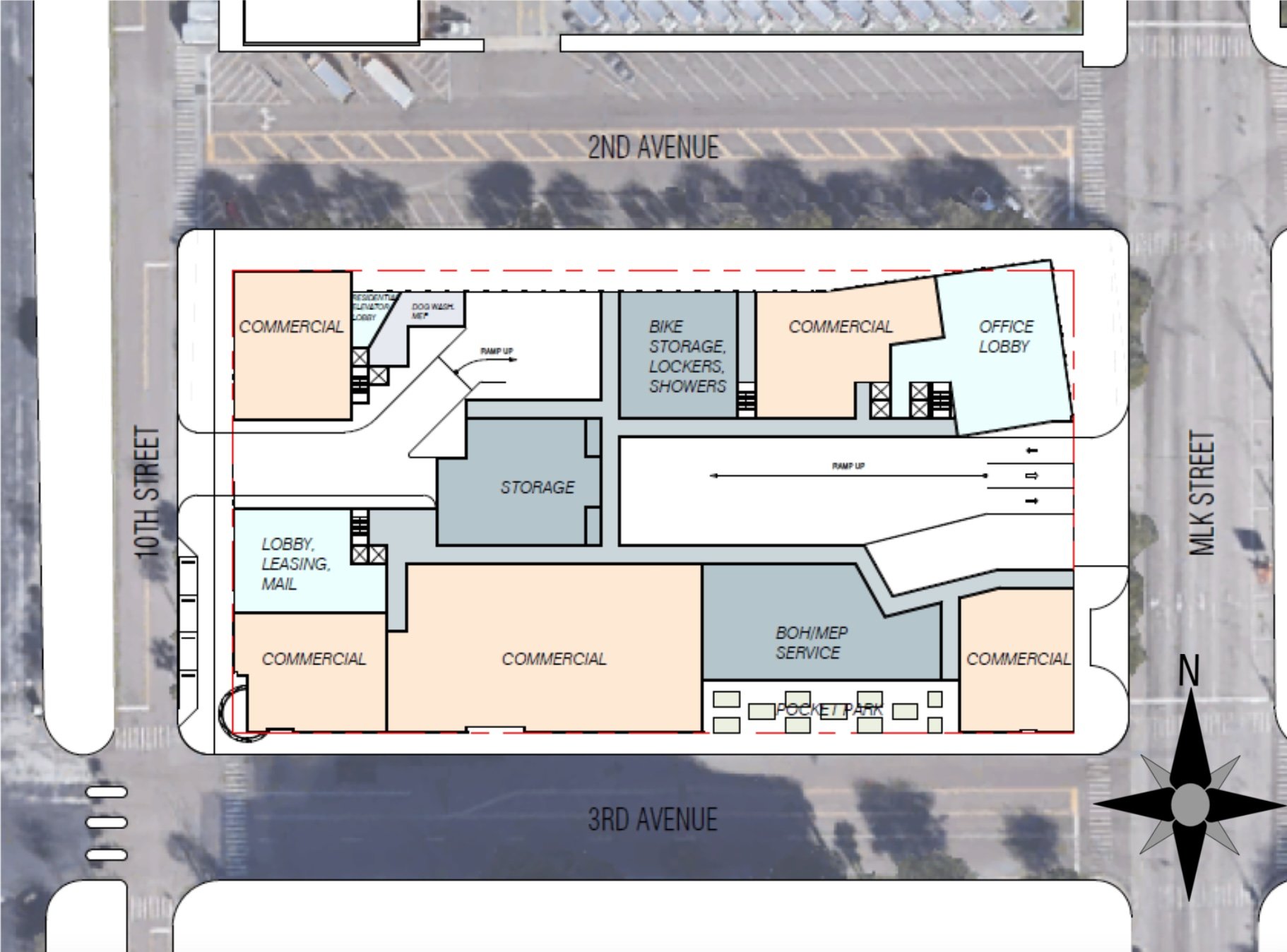

In early November, Atlas Real Estate Partners, which owns The Wayland, a 481-unit apartment complex at 300 10th Street South, submitted an offer to the City of St. Petersburg to purchase a 2.02-acre site located at 910 2nd Avenue South in downtown St. Pete.

The parcel is bound by 2nd Avenue South and 3rd Avenue South between Dr. MLK Jr Street and 10th Street.

On the site, Atlas proposed to build a 10-story mixed-use building that would include 310 residential units along with 20,000 square feet of ground floor retail and 15,000 square feet of co-working space. Atlas offered $5.5 million for the land.

The City of St. Petersburg intends to sell a 2.02-acre site located at 910 2nd Avenue South in downtown St. Pete

The residential units would be a mix of 145 traditional apartments, 79 micro units, 43 units of short-term rentals, and 43 co-living units.

The development would also include a 430-space parking garage of which 120 spaces would be open to the public. Amenities for the building would include a rooftop park, fitness center, community garden, sky lounge, clubhouse, and pool.

As a result of unsolicited offer, and pursuant to Florida Statutes, the city invited alternative proposals from private developers, or anyone interested in the lease or purchase of the site.

Submissions were due earlier this week and six additional proposals are current being considered. An overview of each new submission is detailed below.

Allen Morris

Allen Morris intends to develop a five-story mixed-use project featuring office, multi-family with an affordable housing component, ground floor retail, and public parking.

Office: 100,000 SF Class A Office Space

Residential: 400 Class A apartments with an average of 800 square feet. 15% (or 60 units) will be affordable housing at 120% AMI.

Retail: 20,000 square feet of street-level retail

Parking: 1,126 total spaces in a structured garage. 226 spaces will be dedicated for City/Public use

Allen Morris has offered to purchase the site from the City for $5.5 million. The company expects to break ground by Q3 2023 and complete the project by Q3 2025.

The Allen Morris Company founded in 1958, is a sixty- three-year-old, family-run, and Florida-based real estate development company with a history of building-to-own that lends itself to projects with a higher level of care and finish. The company has more than 85 successful development projects credited to its name.

In 2017, Allen Morris completed construction on The Hermitage, a 348-unit luxury apartment community at 700 1st Avenue South in downtown St. Pete.

The full proposal can be found here.

Apogee Real Estate Partners

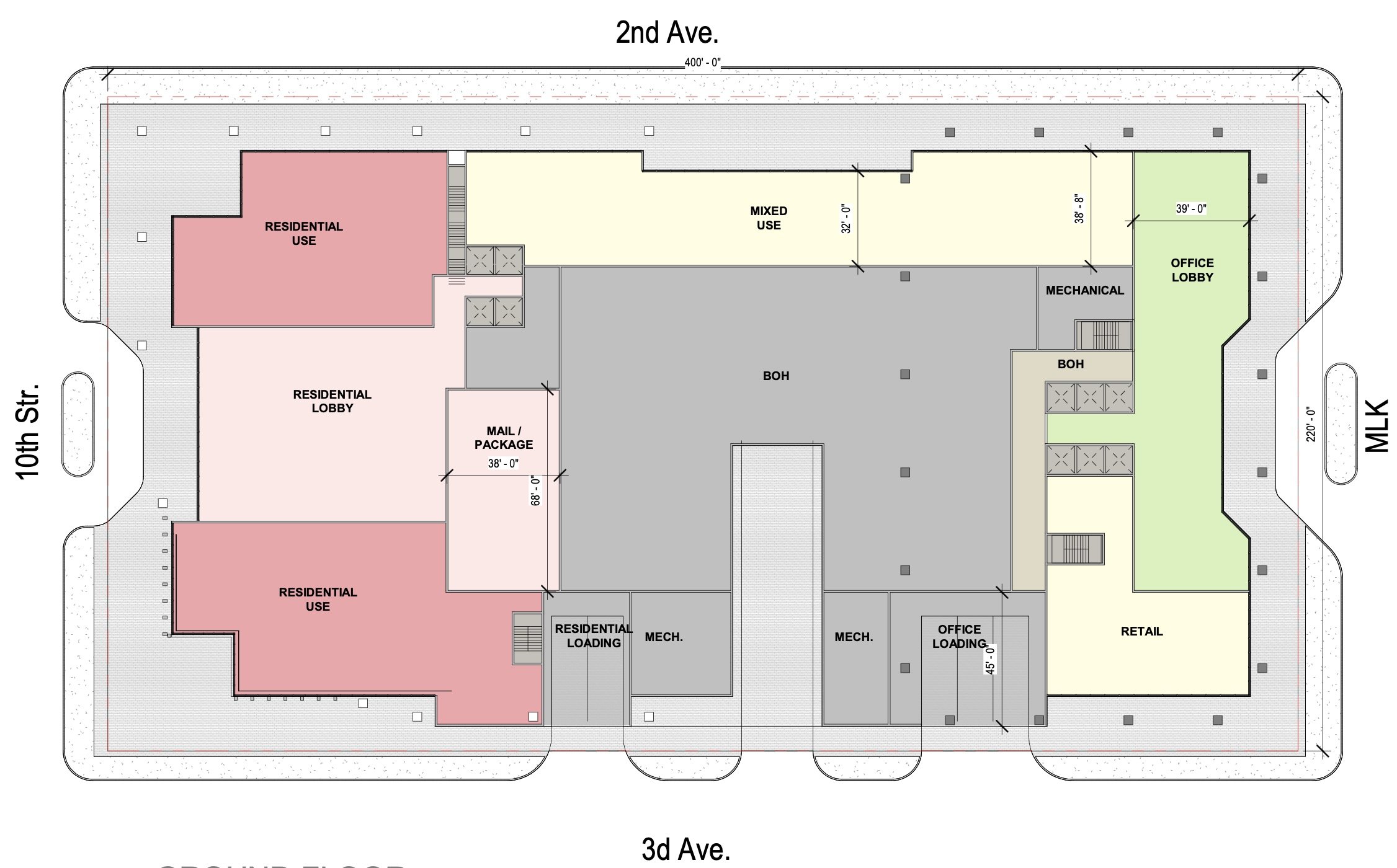

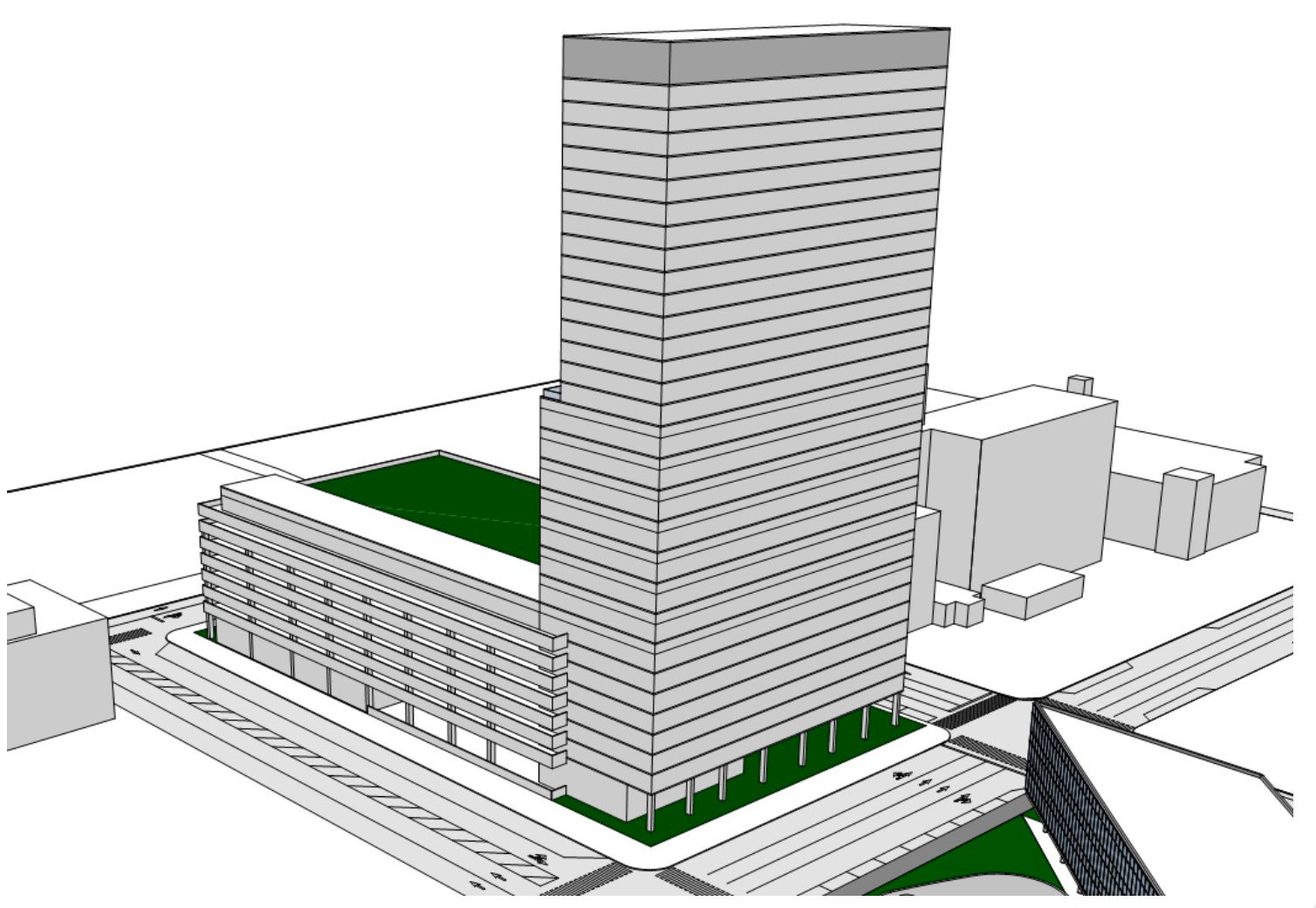

Apogee Real Estate Partners, LLC, a St. Petersburg based development company, in conjunction with architects Nichols Brosch Wurst Wolfe & Associates, and office leasing specialist Wendy Giffin of Cushman Wakefield has proposed a development plan that consists of two towers over podium parking.

Office: In Tower 1, approximately 216,000 square feet of Class A office space in nine floors fronting Dr. Martin Luther King Jr. Street South.

Residential: In Tower 2, Approximately 360 Class A apartments in a 25-story tower fronting 10th Street South. 10% of proposed units will be available as workforce housing.

Parking: A five-story parking garage with and additional level of parking below grade to accommodate approximately 1,050 stalls, of which, approximately 500 spaces will be available for public use during non-working hours, weekends and holidays.

Apogee has offered to purchase the site from the City for $5 million.

St. Pete-based Apogee is helmed by John Stadler, John Barkett, and Gordon Crozier.

Stadler has served the Florida real estate market for decades, primarily due to his service as CEO of Stadler Associates, Inc., the largest real estate brokerage company in Florida.

Barkett has worked in real estate in Tampa Bay for more than 30 years as an appraiser, development partner and real estate broker.

Crozier has over 30 years of executive level real estate experience and is well versed in all phases of real estate development from site evaluation to asset disposition.

The full proposal can be found here.

Blake Investment Partners

Blake Investment Partners and Eastman Equities have proposed to develop a mixed-use multi-family, retail, and office structure on the site.

The group has committed to set aside 10% of their residential units for workforce housing.

The proposal would also incorporate public parking into the structure in order to help address the parking needs of the City along central and the newly activated 9th Street corridors.

Additionally, Blake and Eastman would invite medical research tenants to the project in conjunction with Moffitt Cancer Center, who was recently selected to develop a world-class outpatient facility nearby.

Blake and Eastman also believe that UPC would be an ideal tenant or office condo buyer.

Blake and Eastman has offered to purchase the site from the City for $15 million.

Blake Communities has a track record of over 17 years of projects in the City. The Company operates in eight states and has successfully undertaken over 100 development projects.

Eastman Equity is a real estate investment firm whose focus is on place-based development and urban retail investments in Florida.

The full proposal can be found here.

Dynasty Financial Partners

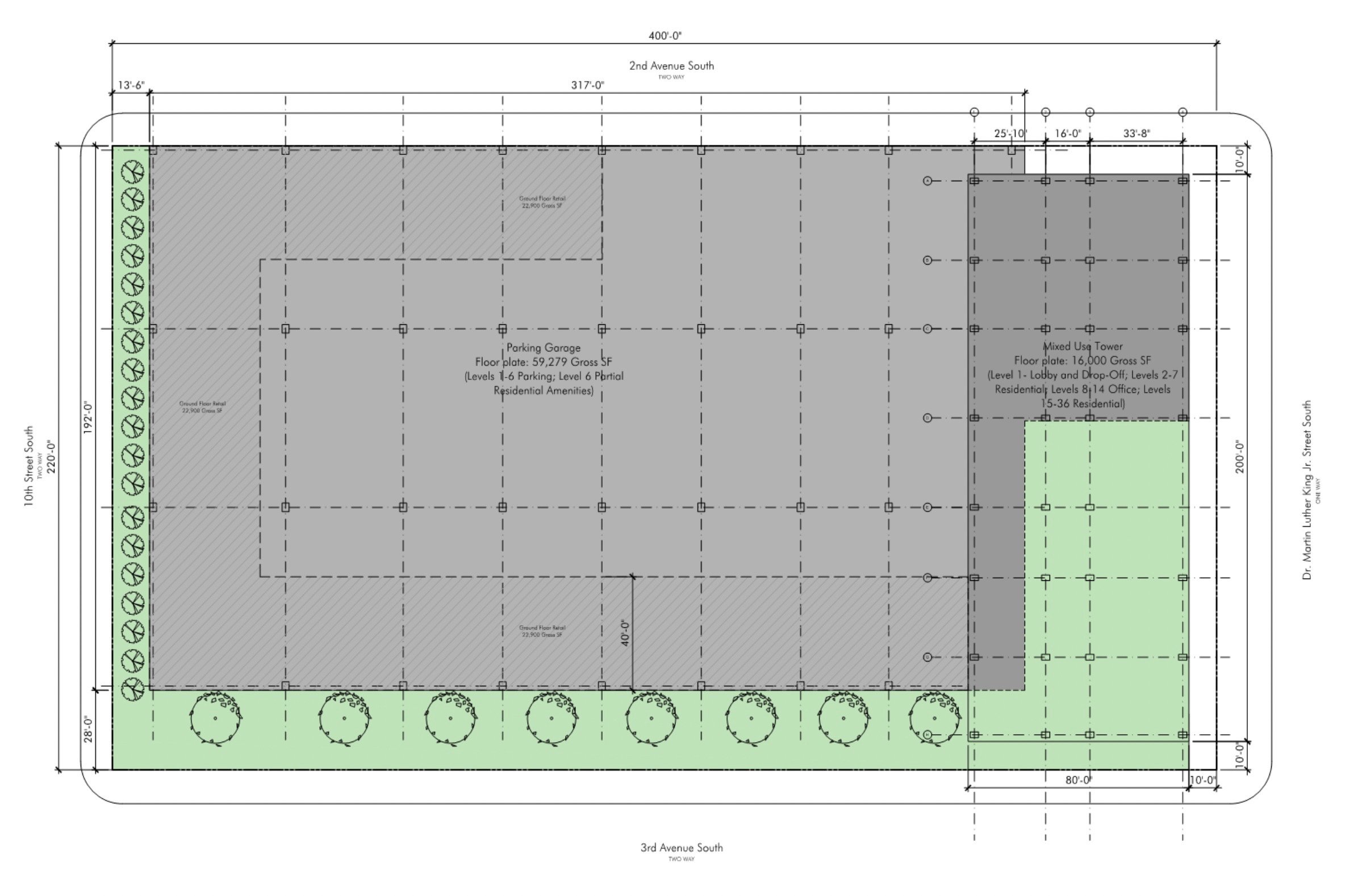

A group consisting of Dynasty Financial Partners, ARK Invest, and GF Investments has proposed a 36-story mixed-use development including Class A office, residential, retail anchored by celebrity chefs, and an Innovation and Recruiting Hub.

Office: 60,000 - 90,000 square feet of Class A office space across seven floors, which will serve as the headquarters for Dynasty, potentially ARK Invest, as well as other entrepreneurial companies with a focus on innovation in Financial Services and Data Analytics.

Residential: 350 - 400 multi-family apartments across 28 floors that will include a combination of affordable housing options with a 12% Workforce housing component will be included as part of the Project.

Retail: 15,000 - 20,000 square feet of retail space, including one or multiple destination celebrity chef restaurants. Through Dynasty’s relationships, Iron Chef and Michelin star holder Marc Forgione of New York and James Beard Foundation Award-winning Chef Michelle Bernstein of Miami have expressed an interest in bringing their culinary talents to the Project.

Parking: A mutually agreeable parking plan that aims to provide sufficient parking to satisfy the requirements identified in the Rays Stadium Plaza Lot Lease without negatively impacting the visual appeal of the neighborhood.

The Project contemplates an Innovation and Recruiting Hub with potential participation by Dynasty, ARK Invest and Cathie Wood, Third Lake Partners and Ken Jones, and Revolution (parent company to Rise of the Rest) and Steve Case.

The Innovation Hub is proposed to include the following:

Co-working space for startup companies in the target industries of Financial Services and Data Analytics

Access to leading companies and entrepreneurs within the target industries

Introductions to leading investors within the target industries

Introductions to a network of potential clients for startups in the target industries

Community events bringing together local entrepreneurs, business leaders, investors,

and public and private organizations focused on innovation and economic development

Dynasty Financial Partners has offered to purchase the site from the City for $6.25 million.

Dynasty Financial Partners is a leading provider of technology-enabled wealth management solutions and business services to independent financial advisors. Dynasty moved to St. Petersburg in 2019 and has been a strong advocate for the city since day one.

ARK is a leading investment management firm focused on disruptive innovation with over $50 billion assets under management. Cathie Wood and ARK moved to St. Petersburg in the fall of 2021. ARK will be launching the ARK Innovation Center in partnership with Pinellas County located in downtown St. Petersburg.

GF Investments is a New York based private family office with a proven track record of successful real estate investments. the company developed approximately 10,000,000 square feet of Class A office and retail space.

The full proposal can be found here.

Mill Creek Residential

Mill Creek is proposing Modera Nine Ten, a mixed-income high rise multifamily rental community with ground floor retail, parking and related amenities.

Residential: 385 apartments. 15% of the apartments will be provided as workforce housing for people qualifying at 120% of AMI.

Parking: MCR will provide 226 spaces in a structured parking garage available for public parking and the satisfaction of the City’s parking lease obligation with the Tampa Bay Rays.

Mill Creek has offered to purchase the site from the City for $10 million.

Mill Creek Residential develops, builds, acquires, and operates high-quality rental communities in the nation’s best markets. Since 2011 they have grown to become the nation’s third largest apartment developer, and we has deployed more than $12.0 billion of capital across more than 42,000 apartments and nearly 1.0 million square feet of retail.

Modera Nine Ten would represent their third community in Downtown St. Petersburg. The company recently purchased 2.86 acres west of Tropicana Field where they intend to develop Modera St. Petersburg, a 383-home high rise multifamily community. Previously, they developed Modera Prime 235 along Downtown’s 3rd Avenue.

The full proposal can be found here.

Trammell Crow Residential

Trammell Crow, along with architect Dwell Design Studio, civil engineer Kimley Horn, and landscape architect b+c Studio has proposed to develop 300 institutional grade apartments in a seven-story building configuration.

The 300 units are to be broken down into 45 (15% of units) workforce housing apartments at 120% AMI, 15 live-work townhomes, and 240 market rate apartment units.

The ground level live-work townhomes are designed to activate the street level pedestrian experience around the development and connect the community to the surrounding neighborhood.

In addition, the community will include a rooftop amenity deck to provide unparalleled views of downtown St. Petersburg, and provide an amenity package that is focused on working from home.

Tramell Crow has offered to purchase the site from the City for $13.5 million.

Trammell Crow Residential is one of the largest developers in the United States. In their 40+ year history, they've developed over 260,000 residential units with a total project cost of $9.3 billion.

The full proposal can be found here.